Basic vs Diluted Shares: Impact on EPS and Ownership

Understand the difference between basic vs diluted shares, how each affects earnings per share, and why dilution matters for investors and company valuations 5 min read updated on August 07, 2025

Key Takeaways

- Basic shares represent the total outstanding common shares of a company, while diluted shares include all potential shares from convertible securities.

- Diluted shares impact financial ratios, such as earnings per share (EPS), providing a more conservative view of a company's profitability.

- Calculating both basic and diluted EPS is required under accounting standards (GAAP), helping investors understand potential dilution risks.

- Differences in basic vs diluted shares become critical in scenarios involving stock options, convertible bonds, and warrants.

- Understanding the implications of dilution is essential for investors assessing share value, company performance, and future ownership stakes.

Basic Shares vs. Fully Diluted Shares

Basic vs. diluted shares are the two methods, imposed by the Financial Accounting Standards Board in 1997, for companies to report their per-share earnings. This is important because per-share profits are at the center of all things financial.

It's these shares that show investors their portion of the company's profits. Basic and fully diluted shares are how the amount of shares investors hold in a company are measured. Basic shares include the stock held by all shareholders, while fully diluted shares are the total number of shares if the convertible securities of a company were exercised. These securities include stock options, stock warrant, and convertible bonds, among other things.

Diluted shares must always be used when calculating a company's MVE, or market value of equity, as the market values company shares using diluted stocks. The number of diluted shares can cause discrepancies in important figures, such as a company's EPS, or earnings per share; the diluted EPS can affect the basic EPS.

What Causes Share Dilution?

Share dilution occurs when a company issues additional shares, decreasing existing shareholders’ ownership percentages. Common causes include:

- Exercise of stock options (by employees or management)

- Conversion of convertible bonds or preferred shares into common stock

- Issuance of new shares for fundraising, mergers, or acquisitions

- Warrants exercised by investors

Dilution impacts not just voting power, but also key financial metrics like earnings per share (EPS), as profits are spread across a larger number of shares. Understanding the difference between basic shares and fully diluted shares is crucial when evaluating your true economic interest in a company.

Why Does the Difference Matter for Investors?

The distinction between basic vs diluted shares matters because:

- Basic share count shows current ownership stakes, while diluted share count reveals potential dilution if all convertible securities become common shares.

- Diluted EPS often provides a more conservative estimate of profitability, especially for companies with significant outstanding options or convertible securities.

- Investment decisions, valuations, and acquisition prices frequently use diluted figures to avoid underestimating potential dilution risks.

Failing to consider dilution may result in overvaluing a company or misunderstanding your proportional claim on its profits.

Basic EPS vs. Diluted Earnings: Analyzing Income Statements

It's important to know the difference between basic EPS and diluted EPS when analyzing a business's income statement. This is especially important for investors, as using the wrong EPS figure can lead to incorrect information — such as misleading PEG, price-to-earnings, and dividend-adjusted PEG ratios.

When looking into the profit and loss statements of a company, it's important to do research on two different levels. The first is looking at the entire business deciding how profitable it is, and the second is examining the profits per share — how much pretax profits each shareholder receives per owned share; publicly traded companies are divided into shares that represent part of the overall ownership pie. The second figure is the most important for individual investors. If a company's profit increases every year but little profit reaches the shareholders, the businesses profit is less important as it may be a terrible investment. This problem is fairly common and is likely to be run into.

Shareholder-friendly companies focus on per-share results and prioritize them over company size. Management such as this realizes that each time shares are reissued, the current owners are selling a portion of their business assets and giving them to whomever the new owner is. Luckily, the accountants who developed the GAAP rules came up with a solution. Their solution was to have companies present the earnings in their disclosures using two different methods.

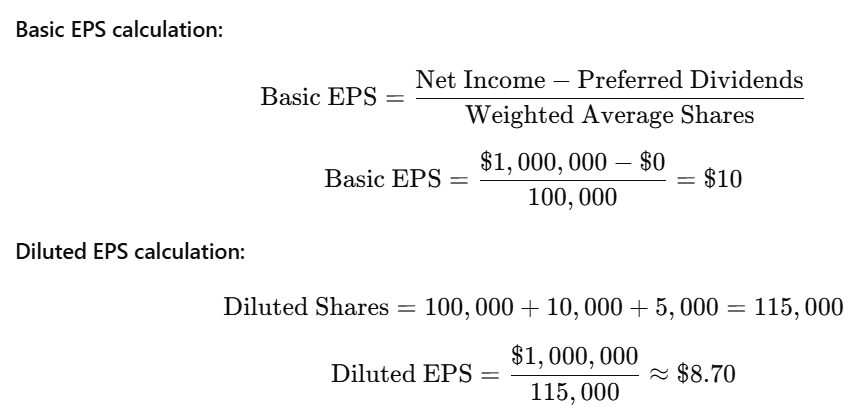

Calculating EPS

Basic EPS and diluted EPS are the two figures required by the GAAP. Basic EPS takes the net income of common shares for a period of time and divides it by the average number of outstanding shares for the same period. Diluted EPS calculations include all convertible securities. Out-of-money options are not included in diluted EPS.

Step-by-Step Example: Calculating Basic vs Diluted EPS

Content:Consider a company with the following:

- Net income: $1,000,000

- Preferred dividends: $0

- Weighted average common shares: 100,000

- Stock options outstanding (convertible to 10,000 shares)

- Convertible bonds (convertible to 5,000 shares)

This demonstrates how potential conversions lower the per-share earnings for existing shareholders.

Using Diluted EPS to Analyze a Business

When calculating diluted EPS, antidilutive conversions are not included as doing so increases earnings per share, which doesn't happen in the real world. Reasons from a practicality standpoint being: If a company has a large amount of potential dilution and the stock price declines, all of that dilution could be lost from the diluted EPS calculation.

Future increased stock prices could bring the dilution back, which makes calculating a long-term diluted EPS difficult. If the stock price is down for a long period of time, some stock options tend to disappear, though this is often accompanied by new stock options being offered at a lower price. Generally, diluted EPS is lower than basic EPS if the company made a profit ,and similarly, diluted EPS will show a lower loss than basic EPS in the situation of a loss. This is because the profits and losses must be divided among more shares.

Limitations and Practical Considerations of Diluted Shares

While diluted EPS provides valuable insight, it has limitations:

- Antidilutive Securities: Securities that would increase EPS if converted are excluded from the diluted share count, ensuring the number remains conservative.

- Market Price Sensitivity: Some options or warrants only become dilutive if the stock price rises above the exercise price.

- Changing Capital Structures: New grants or conversions can quickly alter dilution calculations, making regular review important.

- Reporting Differences: Not all companies are equally transparent in reporting dilution, so investors should always read financial statement notes.

Understanding both basic vs diluted shares helps stakeholders make informed decisions and recognize real versus potential ownership changes.

Frequently Asked Questions

1. What is the main difference between basic and diluted shares?

Basic shares reflect currently outstanding common shares; diluted shares include all possible shares if convertible securities are exercised.

2. Why is diluted EPS usually lower than basic EPS?

Diluted EPS divides net income over a larger number of shares, factoring in potential conversions, thus lowering the earnings per share figure.

3. When should investors use diluted shares instead of basic shares?

Diluted shares should be considered when evaluating company value, acquisition prices, or potential dilution from stock options and convertible securities.

4. What types of securities can cause share dilution?

Common causes include employee stock options, convertible bonds, warrants, and convertible preferred stock.

5. How does share dilution affect my ownership and voting rights?

Dilution reduces your percentage ownership and, potentially, your voting power, as new shares are issued to others.

If you need help with basic vs. diluted shares you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.